|

|

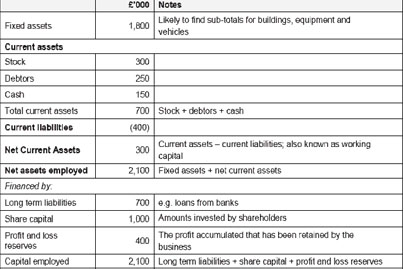

Balance Sheet A Balance sheet provides a snap shot of the assets and liabilities of a business at a point of time. Balance sheet for XYZ plc as at 31st March 2003 Fixed assets are: Assets that provide a benefit for the business in the long-term (normally for at least a year), e.g. buildings and machinery Assets that the business intends to keep Current assets Current assets are assets that will be used up or sold in the next year + the cash balances kept in the business. The main categories are: Stock – finished goods, work in progress and raw materials . Debtors – people who owe the business money Cash – in the bank and in the cash box. Current liabilities Current liabilities are what the business owes in the short run ie within the next year.. The main categories are: Creditors – money owed by the business in the short term Bank overdraft – amounts due within the next 12 months. NOTE: The total of current assets minus current liabilities is known as working capital. This is amount of money available for the day to day running of the business. Long-term liabilities Long term liabilities are the monies the business has borrowed for a period of more than a year. The main ones are:- - Bank loans - Share capital is the money invested in the business by the owners. - Profit and loss reserves are the profits due to the owners that have not already been paid out in dividends. - Shareholder funds – the money invested by shareholders through share capital and reserves added together. |