|

|

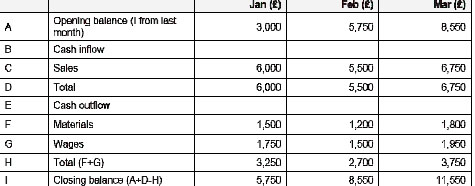

Cash Flow Forecasting A cash flow forecast or budget is used to anticipate when it can pay bills and plan when it might need to make provision for any cash flow problems (e.g. arrange for there to be some finance available in the form of an overdraft or loan). The key elements of a cash flow budget are:- Opening balance How much cash the business has at the start of the time period. Cash inflow How much cash is coming into the business from product sales, sales of assets, loans from the bank, grants from the government, and other sources of finance. Cash outflow How much cash is going out of the business, such as expenses, wages, raw materials, buying new machinery, tax payments and dividends. Closing balance How much money is left at the end of the month. Opening balance carried forward The next time period brings forward the closing balance from the previous time period. Problems with cash flow There are some limitations to cash flow forecasts:- The longer they predict, the more likely they may not foresee changes in the market place e.g. a new competitor may force down the prices of products sold. It relies on estimates of future costs, which may difficult to predict. How to improve a negative cash flow A business can improve its cash flow in the following ways: Agree an overdraft or increase an existing overdraft from the bank. Extend the length of time taken to pay suppliers. Reduce the price of some products to get quick sales. Sell to customers for cash rather than offer trade credit. Sell some equipment. Reduce stock levels. Buy cheaper raw materials. Allow debtors discounts for early payment. Operate tighter customer credit controls ie shorten trade credit periods offered to customers and make sure customers on trade credit pay on time. Use debt factoring. |