|

|

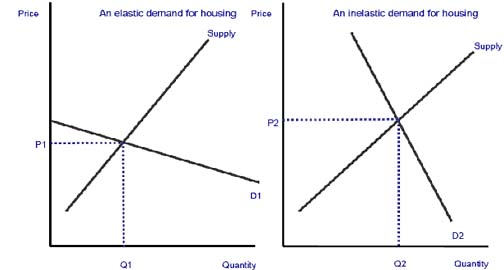

Elasticity of Demand for Housing Price elasticity of demand Price elasticity of demand (Ped) measures the responsiveness of demand for a product to a change in its own price. When housing is regarded as a necessity and when there are few close substitutes available, we expect demand to be inelastic. This may well force up the eventual market price when a transaction is agreed. The price elasticity of demand for a property depends on the availability of close substitutes – for example the supply of rented housing. If you have set your heart on a particular property, or are convinced that you need to live in a specific area, perhaps to live within a school catchment area or because you want to be close to friends and family, then you will be far less sensitive to the market price and demand will become price inelastic. Income Elasticity of Demand for Housing Evidence suggests that the income elasticity of demand for housing in the UK is positive meaning that the market demand for housing grows when real incomes are rising. Income elasticity of demand varies across different types of property. Luxury properties have the highest income elasticity. Housing and the Derived Demand for other products A derived demand exists when the demand for one product affects demand for related (i.e. complementary) products. The housing market is a good example of this. For example when there is a rise in demand for new homes, this creates a fresh demand for the inputs that are used in the design, construction and retailing of homes in other sectors of the economy. A new home represents a tangible product that can be enjoyed by home-owners. But to create this, there are associated demands in the factor markets for essential inputs and labour. The flow chart below tries to show the inter-relationships between product markets, factor markets and capital markets in the economy. |