|

|

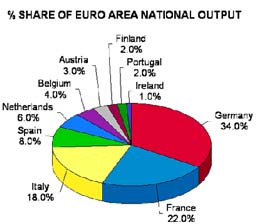

Arguments for UK entry into the single currency Lower transactions costs Joining the Euro would reduce exchange rate uncertainty for businesses and lower transactions costs for companies and tourists. Nearly 60% of our trade is conducted with other members of the European Union - a figure that is likely to grow in future years Increased trade and investment The Euro is vital to the success of the Single European Market. This should lead to an increase in intra-European trade flows and higher inward investment within the EU region. Britain stands to gain from this, particularly if she can maintain low inflation and raise productivity in European markets. Britain's flexible labour and product markets would be highly effective inside a single currency area and would help to attract even more inward investment from outside the European Union Lower inflation and long term interest rates Britain might gain from a period of sustained low-inflation delivered by an independent European Central Bank. If inflation falls, this will lead to lower long-term interest rates and stimulate faster growth and improved competitiveness. The currency union will eventually be more resilient than the Exchange Rate Mechanism. The Euro will be less susceptible to speculative attacks in the global foreign exchanges once growth picks up combined with low inflation The Euro may become a key global reserve currency as part of a new order of currency stability between the Euro, the US dollar and the Japanese Yen " Britain has been a major recipient and beneficiary of foreign direct investment in recent years. Some commentators believe this would be threatened if the UK remained outside the system in the long run. Political Influence Britain stands to lose political and economic influence in shaping future economic integration if it remains outside the monetary system. The Euro is a key component in completing the single market Economic gains for consumers - lower prices due to increased competitive pressure/greater price transparency (more likely with easily transportable goods) - Reduction in transaction costs of travelling within Europe - Cheaper mortgages if interest rates lower and homebuyers can take out mortgages at longer fixed term rates Gains for British Business - Invoicing can be done with just one currency in one centre - Lower transaction costs- no costs in currency conversion - staying out of Euro is equivalent to British exporters facing a tariff - Cheaper sourcing of inputs at wholesale level - Particular gains for UK industry - Businesses might be able to fund capital investment at lower real interest rates Profits - lower profit margins for some businesses (due to greater competitive pressure and less scope for price discrimination) - But higher profit margins for other companies that can make savings through increased cost transparency |